The Kentucky Tourism Development Act: Fueling Major Growth Across Kentucky

The Kentucky Tourism Development Act (KTDA) is powering massive investments and creating a new boom across the state. This incentive offers state tax credits up to 25% of capital costs for approved tourism projects. Let's examine how KTDA is fueling growth and how your business can tap into these benefits.

How KTDA Incentivizes Tourism Projects

KTDA provides state tax credits up to 25% of capital investments in new or expanded attractions and facilities. Here's how it works:

List of Services

-

The ApplicationList Item 1

The business submits an eligibility application to the Kentucky Tourism Development Finance Authority.

-

Incentive OfferedList Item 2

Qualified projects receive approval for tax credits up to 25% of their capital investment.

-

Award NotificationList Item 3

Upon final approval by an independent analysis from a third party, approval is issued by the KTFA (Kentucky Tourism Finance Authority) to approved applicants.

-

Incentive UsageList Item 4

KTDA credits provide sales tax relief to approved projects, with recipients able to apply the credits each year for 10 years to lower their tax obligations.

Since 2007, over $4.5 billion in tourism projects have been approved under KTDA, driving growth across Kentucky. Hotels, distilleries, resorts and more qualify.

Major Investments Powered by KTDA

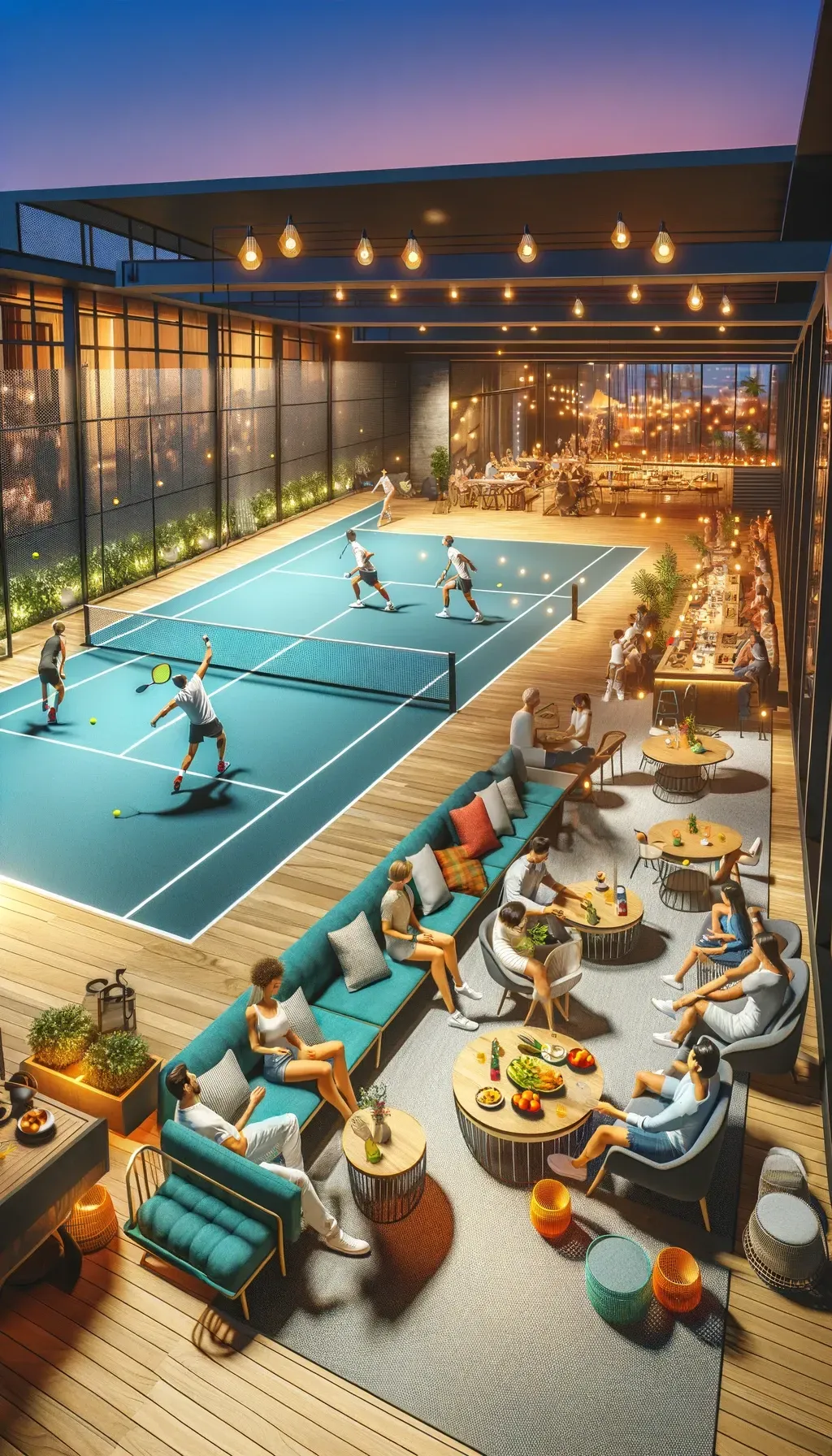

Recreational uses, convention centers, ski resorts and other concepts have leveraged KTDA credits to become reality.

Is the KTDA Right for Your KY Tourism Concept?

Bottom line: KTDA can make large-scale projects more achievable. It provides:

- Maximized ROI on investment

- Offset risks of major developments

- Tax revenue and job creation

- 5-year window to use credits

The application process is complex, but the reward is immense for approved projects. For any major KY tourism investment, KTDA presents an opportunity not to be missed.

Let's Discuss Your Concept

If you have a major tourism project in mind for Kentucky, our team can help you tap into the KTDA incentive. Contact us today to explore how we can guide your application and leverage this program to turn your concept into reality.