Stocks are Expensive, and Increasingly Concentrated – Presenting an Opportunity for Commercial Real Estate

By Mac McLean

*Market conditions and data referenced in this article are current as of December 23rd, 2025.

Equity Markets Delivering Exceptional Returns

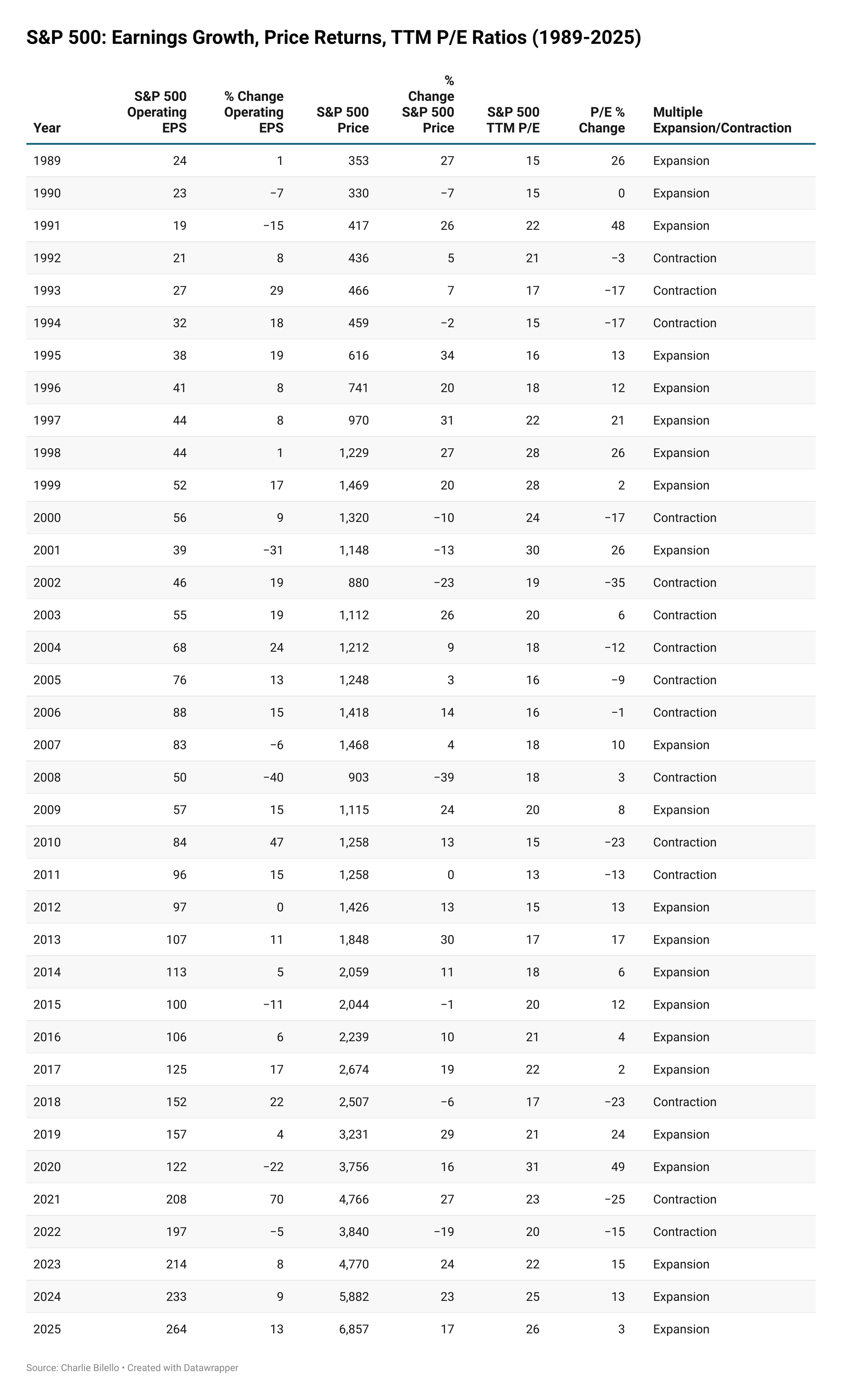

The S&P 500 has been on a tear over the last three years, posting gains of 26% in 2023, 25% in 2024, and another 14% as of early December 2025. All three years have strongly outpaced the market’s average annual return of 10.56% since 1957.

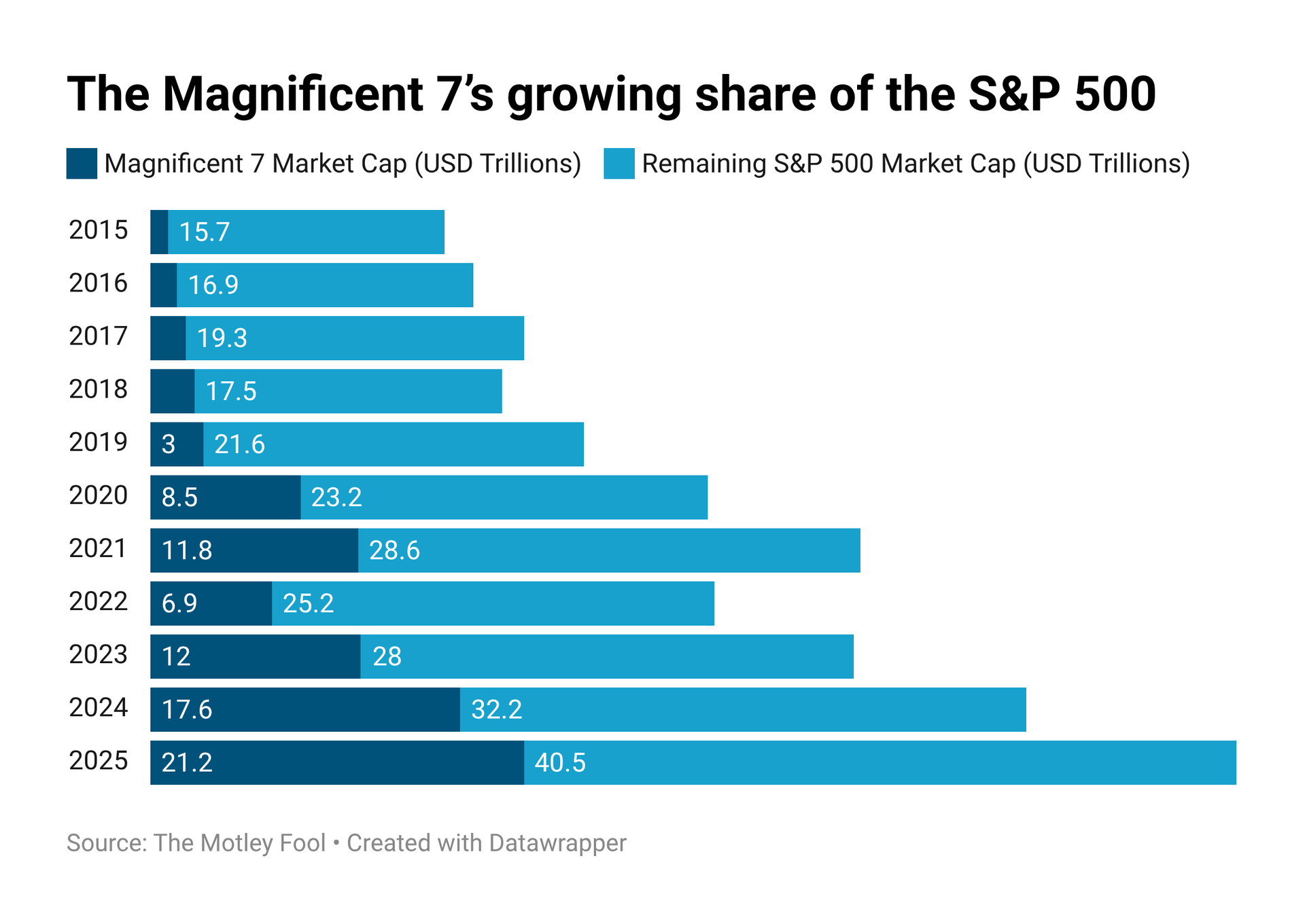

A significant portion of that growth has been driven by large bets on artificial intelligence as companies race to develop their own AI platforms and networks. The Magnificent Seven stocks (Alphabet, Amazon, Apple, Meta, Microsoft, and Nvidia) now account for nearly 35% of the S&P 500's total market capitalization. By comparison, those stocks accounted for only 21.5% of the overall market cap in 2022.

Recent Market Gains Are Driven by a Narrow Group of Companies

High concentration isn’t necessarily a bad thing. It can, however, magnify both opportunities and risks. Investing in the S&P 500 or other index funds has historically provided investors with an opportunity to diversify their portfolios by exposing them to the entire stock market. With the Magnificent Seven comprising such a large share of the total market capitalization, that diversification is increasingly diminished.

Valuations have followed suit. The S&P 500’s P/E ratio has remained historically high in recent years, reaching 26.0 in 2025 for the third consecutive year of expansion. That figure is 31% higher than the historical average of 19.8 since 1989. These strong valuations, driven by artificial intelligence, have sparked fears of a bubble as equities have become increasingly expensive. While high valuations do not guarantee a downturn, they do imply that the stock prices are overvalued compared to their actual earnings or that investors are speculating on future growth opportunities.

Discounts in Commercial Real Estate

Commercial real estate, by contrast, has been trending in the opposite direction. According to the WSJ, U.S. commercial real estate values are down an average of 17% from their 2022 peak. The office and apartment sectors, in particular, have seen sharp declines, falling 36% and 19%, respectively, from that same year.

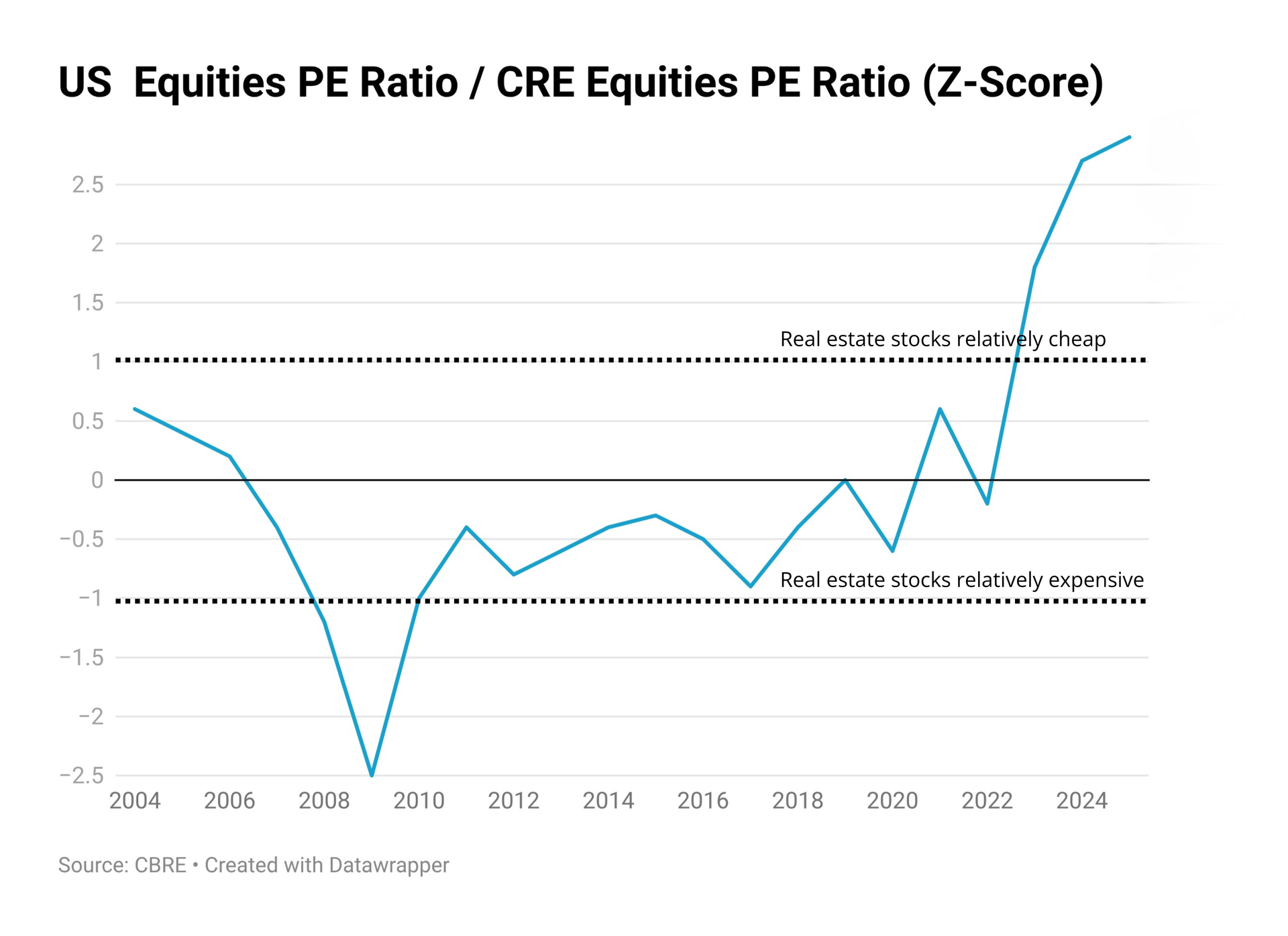

Real estate stocks reflect this trend as well. According to Green Street, publicly traded REITs are trading at a strong discount relative to the PEs of other non-real estate equities.

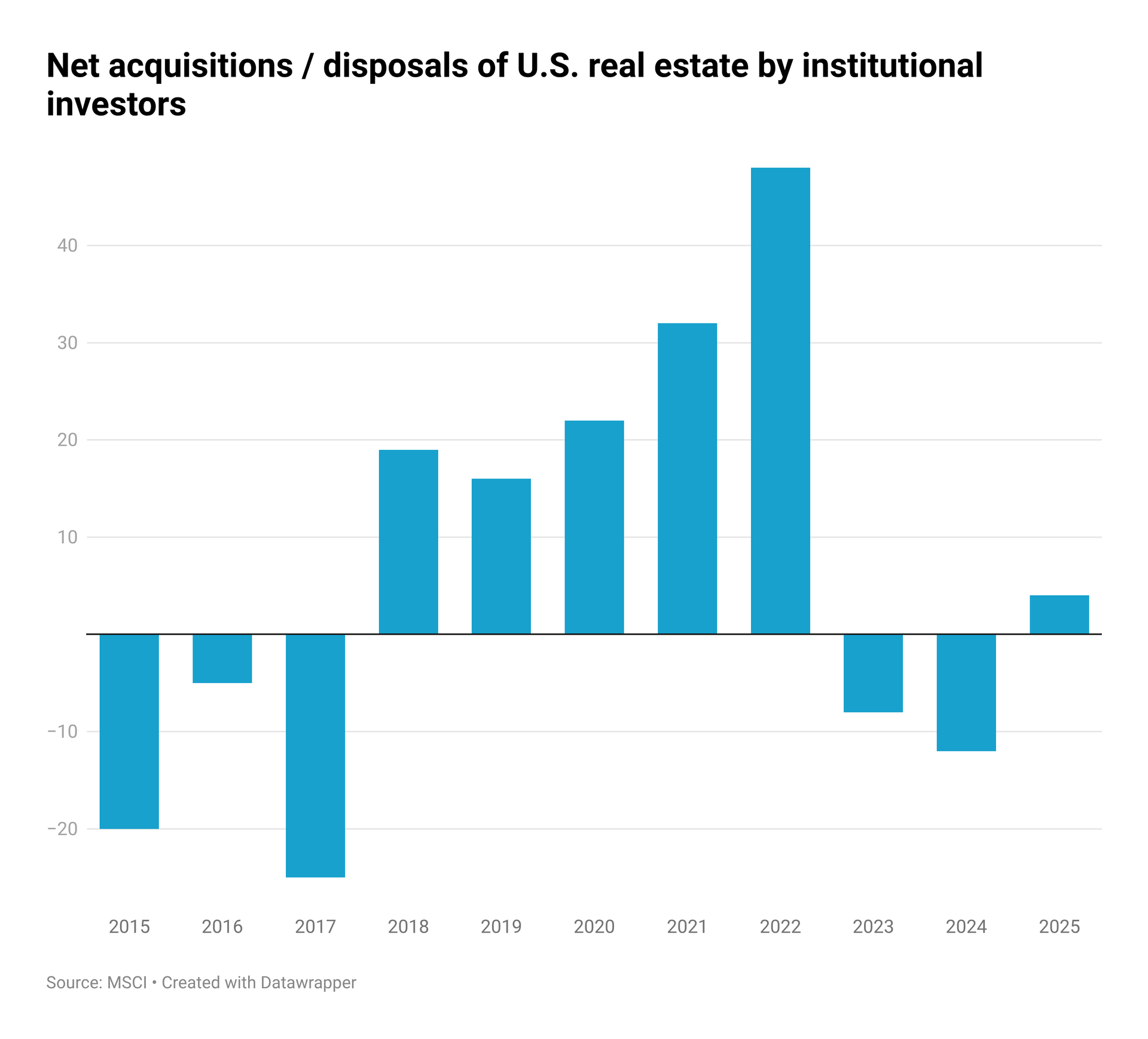

This presents a rare buying opportunity for CRE investors, and institutional investors have taken notice. MSCI reported that, for the first time in three years, institutional investors acquired more properties than they sold, albeit at a lower volume than during 2018 – 2022. While transaction volumes remain below peak levels, this shift suggests that investors are beginning to re-enter the market to take advantage of discounted assets.

2026 Real Estate Outlooks and Opportunities

- Multifamily: Nationally, construction levels have fallen to pre-pandemic levels after years of heavy construction. Q3 saw the pipeline fall 50% from its peak and 17% below pre-pandemic averages. Despite years of construction and deliveries, the housing shortage is still expected to grow nationally. In Kentucky alone, the shortage is expected to reach 287,000 units by 2029.

- Industrial: Industrial onshoring and nearshoring are expected to continue as companies work to shorten supply chains and mitigate risks tied to geopolitical uncertainties and shifts in economic policies. The construction pipeline is thinning nationally, falling to 270M SF this year, down 63% from its peak in 2022. National rent growth should rebound after slowing down over the past several years due to the influx of new construction.

- Retail: Nationally, limited retail construction has kept retail vacancies remarkably low, hovering around 4.5–5.0%. That trend is expected to continue into 2026. A barbell economy is forming in the retail sector, with mid-tier retailers facing mounting pressure from rising costs. Retailers offering either affordable products or luxury items to high-income consumers should continue to perform well.

- Office: Although office is still the most challenging sector, opportunities are still available. Office conversions are becoming more common as excess supply is removed from the market. MWM is seeing this trend locally in Lexington, where our firm is based.

- The Vine – 63,693 SF of office converted to residential condos and restaurants

- Truist Building – 91,500 SF office building planned to be converted to government use

- 200 E Main Street – 135,402 SF (former government building, planning to sell to affordable housing developers)

Collectively, approximately 300,000 square feet of downtown office space is expected to come off the market over the next few years, tightening office supply in downtown Lexington. This should result in modest rent growth for office landlords as excess supply is removed.

MWM's Role

A window of opportunity is opening in commercial real estate, and success will be defined by execution and local market knowledge. As sidelined capital returns to the market, MWM anticipates increased investor activity focused on high-quality, well-located assets. Every member of the MWM team is a licensed commercial real estate professional through our affiliation with Block + Lot Real Estate, allowing us to provide fully integrated advisory and brokerage services under one roof.

In practice, this means partnering with buyers to evaluate opportunities, analyze market trends, and guide transactions from start to finish. MWM works with clients across Kentucky and the broader Southeast to identify and execute successful commercial real estate investments.If you are evaluating opportunities or thinking through your investment goals, we are always happy to connect and discuss how current market conditions may align with your real estate strategy.