What happened in 2025 and where are we going next?

By Lucas Witt

A Yearly Recap

A statistic that has been consistent for decades is that about half of US small businesses fail within 5 years, and only a third of them will still be operating after 10 years. At MWM Consulting, we just completed our 5th full year of operation, and I am here to confirm that not only are we surviving, but we are also thriving.

2025 was a year of recalibration for our firm. Like many companies across the country, we quickly pivoted in response to the new administration's policies. Some could say we were “DOGED” (referring to the Department of Government Efficiency, “DOGE”) as the federal government slashed funding nationwide.

From a business perspective, this helped us realize our clients and our work were too focused on federally funded projects. We were also entering our 5th year of operation. It was time to pivot.

We recentered to where our expertise is deepest:

- Helping communities and organizations understand their competitive strengths and market realities

- Developing real estate-anchored strategies that align with those insights

- Executing real estate outcomes that bring economic development goals to life

In short, we are not “just” economic developers, nor are we “just” commercial real estate brokers. We are strategic advisors with real-world impact in both domains, and we bridge the gap between planning and execution.

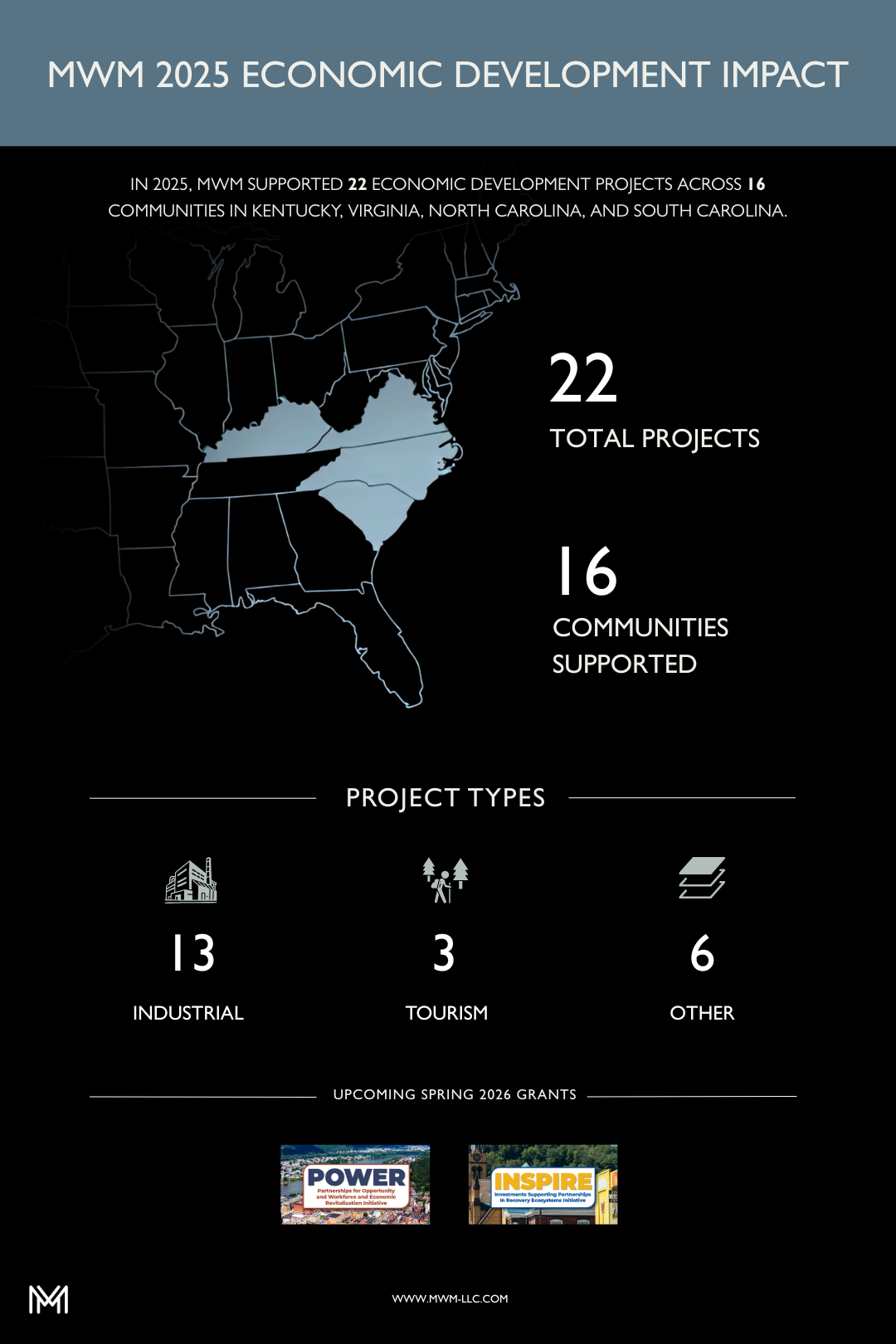

Economic Development Impact. Meaningful, Multi-State, Multi-Sector

In 2025, MWM supported 22 economic development projects across 16 communities in:

- Kentucky

- Virginia

- North Carolina

- South Carolina

The work was far from one-dimensional. The projects we served included:

- 13 industrial / incentive-related initiatives

- 3 tourism-focused efforts

- 6 diverse economic development engagements

Each of these projects had a targeted work scope with a unique set of criteria. Ranging from assisting

Infiltrator Water Technologies through their $40 million expansion in Winchester, KY, to advising what may be the most significant and most impactful regional project in Kentucky, including the Lexington-Fayette Urban County Government, Madison County Fiscal Court, Scott County Fiscal Court, and the City of Berea. These projects have real meaning and will deliver real results.

Commercial Real Estate: Strategic Advisory and Relentless Execution

While many firms treat economic development and real estate as separate levers, we treat them as complementary.

This year, through our affiliation with Block + Lot Real Estate, MWM members were part of approximately $70 million in commercial real estate transactions in 2025, including:

- 15 leases executed

- 13 buildings sold

These transactions range from leasing industrial facilities in tertiary markets across Kentucky to advising a corporate client on multi-family and land acquisitions in states like Virginia and Alabama to closing what may be the largest flex industrial real estate portfolio sale in Lexington, KY, in 2025. Our team is strategically positioned to advise clients through complex transactions while managing day-to-day needs.

2025 Market Overview

Our market perspective this year is more macro in nature, reflecting our growing multi-state presence.

Economic development and commercial real estate remained tightly linked in 2025, with capital becoming more selective even as investment activity picked up in the second half of the year. Speculative industrial development fell to its lowest level in roughly a decade, driven by sharp pullbacks in construction starts and project pipelines, which have redirected leasing activity into existing, already-delivered properties.

Industrial, office, and retail each told a different part of the story.

Industrial saw constrained new supply, even as leasing velocity remained healthy and net absorption improved later in the year. In my mid-year letter, I touched on record levels of “dry powder” and its eventual deployment. The “dry powder” that had been sitting on the sidelines began to move, with industrial sales volume up year-over-year and overall CRE transaction activity rebounding in the back half of 2025.

In the office sector, Class A is quietly mounting a comeback: prime, amenitized buildings in markets like Manhattan, Austin, Nashville, and similar growth cities posted positive net absorption and falling vacancy, while older Class B and C assets continue to struggle and are increasingly targeted for conversion or repositioning.

Retail, meanwhile, enjoyed one of its strongest years in recent memory, supported by solid consumer spending, tight supply, and growing institutional interest. Forecasts for the 2025 holiday season call for a record level of expenditure, with predictions showing consumers crossing the $1 trillion mark in holiday spending for the first time.

We have a clear and consistent take at MWM: commercial real estate is more than just assets to buy, sell, or lease; it is the physical platform for jobs, services, and daily life. Strong performance in these property types directly advances quality of life, which is why any honest discussion of economic development must also account for the real estate that makes growth tangible in communities.

Final Thoughts and Looking into 2026

As MWM enters its 6th year, one theme has been consistent: any success we have achieved is a direct result of the communities, partners, and clients who trust us to stand in the space between economic development and commercial real estate. I am proud that our growth has been largely organic, which is the best kind. To all our past and current clients, thank you. We would not be here without you.

Looking to 2026, I remain very optimistic. This is not just blind optimism either. It is rooted in data, and a few themes stand out. East Coast port activity has recently surpassed the West Coast, which had long been the leader. Like many other firms, we anticipate the southeastern market to continue gaining momentum in 2026 because of this transition.

Class A office is likely to extend its gradual recovery, as high-quality, well-located buildings capture a disproportionate share of leasing and investment activity. This does not replace the fact that older-generation office buildings will continue to struggle and will likely be targets for conversion, specifically in the larger metros.

As for MWM, we remain committed to integrating our economic development efforts with our commercial real estate advisory. These two areas of expertise allow us to serve our clients at a level that stands out from the rest. We are committed not only to maintaining our quality of work but also to elevating it in 2026.

Thank you to everyone who has trusted us thus far. For those of you who have not yet worked with us, we look forward to crossing paths in the new year.

Lucas Witt

Founding Partner

MWM Consulting