MWM Mid-Year 2025 Letter

By Lucas Witt

Volatility, Patience, and Positioning for What's Next

We're halfway through 2025, and if there's one word that best describes the market right now, it's uncertain. At MWM, we've seen the effects of that uncertainty across the board: slower deal cycles, cautious capital, and communities navigating a more complex investment landscape than they've faced in years. Projects are still happening, but they're moving at a different pace, and the risk profile on all sides has shifted.

But we're not discouraged. In fact, we believe this kind of market often presents the greatest opportunity.

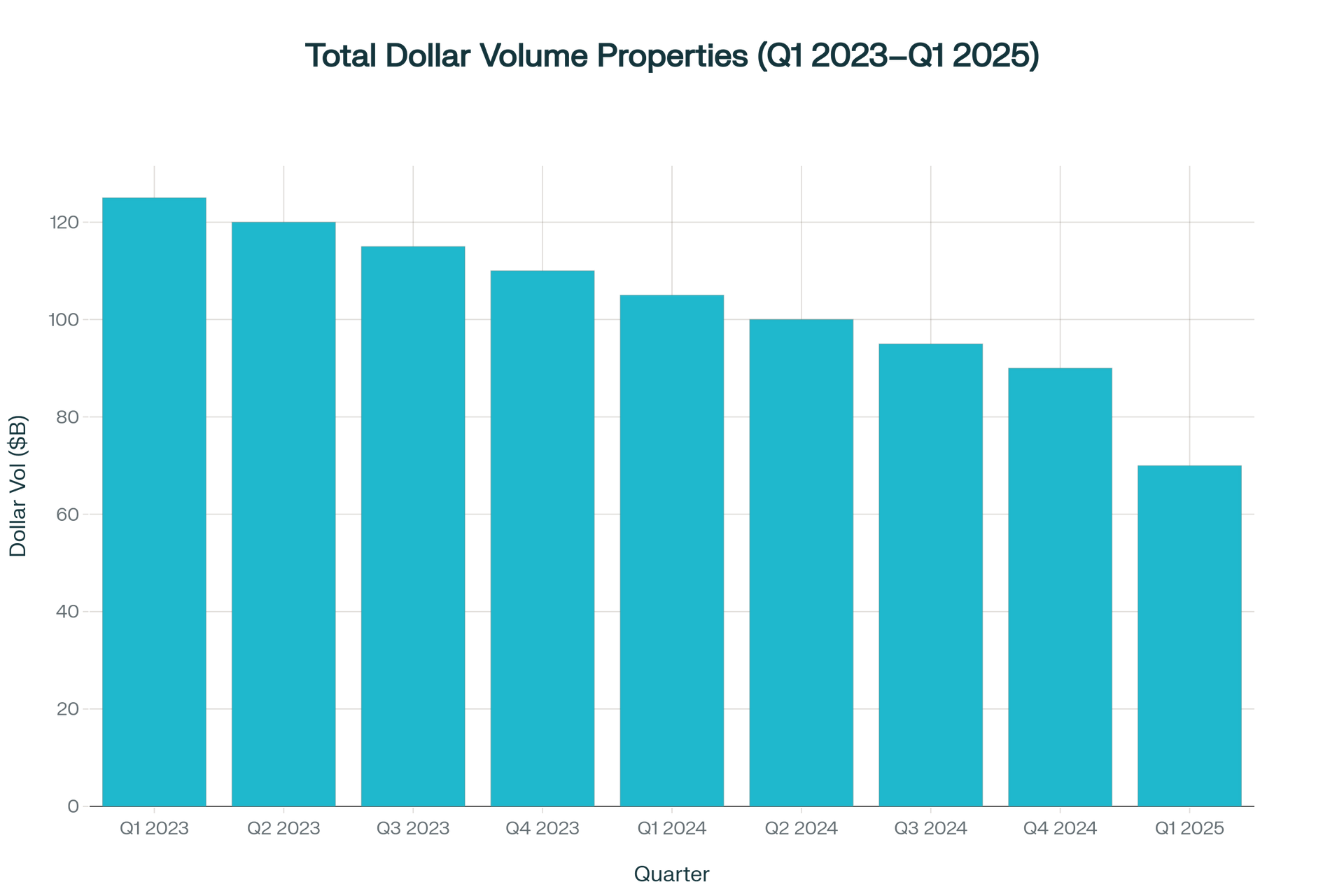

CRE Market Perspective - Q1 Transaction Volume vs. Prior Quarters

Across the country, commercial real estate activity remains well below the peaks of 2021-2022. U.S. deal volume in Q1 2025 was just under $70 billion, which is down about 19% year-over-year. This continues the slow decline that began in 2023 where deal volume dropped by nearly half compared to 2022.

Industrial Sector Insights

The industrial sector, which has been one of our primary focus areas, is showing signs of significant change. For the first time in a decade, supply has outpaced demand as outlined in a report by CoStar. Vacancy rates, which were recently below 4%, are now greater than 7% across the country. Location, as has always been the case in real estate, still matters though. For example, Central Kentucky’s industrial vacancies have historically hovered below the national average and that story remains unchanged with industrial vacancies holding steady at 5%. Furthermore, the size of the building is increasingly more important. The market was rushed with hundreds of millions of SF of speculative buildings built between 2021 – 2024. The everyday users of 50,000 SF and below are dominating the market currently.

Office Market Reset

The office market is still challenged, but even here, there are signs we may be nearing a reset. Prices are down ~12% from mid-2024, and distress-driven sales are beginning to establish new comps. That creates a unique opening for long-term buyers looking past today's headlines. The data also tells us that activity is back to pre-pandemic levels. Albeit the average size of each lease is smaller (roughly 3,000 - 4,000 SF/deal). This is not meant to be a bold prediction that the office market is "back" as it is forever changed. However, the activity in the office market is incredibly interesting considering the fact we saw more office sales in Q1 of 2025 than we have seen in several years. This includes end users along with investor type transactions.

Capital on the Sidelines

And perhaps most telling: there's more dry powder (cash on hand) sitting on the sidelines than ever before. Global private equity firms and institutional investors are holding an estimated $382 billion in undeployed capital earmarked for real estate. It's not a question of whether it will be deployed, but when and where.

What This Means for Economic Development

If you're a community or a corporate client reading this, our advice is this: the best time to prepare for growth is before the next wave hits. In slower markets, competition for projects softens, land pricing normalizes, and smart planning creates leverage that pays off down the road. Uncertain markets are more difficult for corporations to make decisions. However, this is the time for communities to be proactive and to follow industry driving data. We're encouraging communities to lean into regional collaboration and to take a serious look at site readiness. Not just for today's demand, but for what's coming.

At the same time, we're actively working with partners who want to acquire or reposition assets while pricing is still resetting. The best deals are usually not made in the hottest markets. They get made right before the rebound.

Final Thoughts

We don't know exactly what the second half of 2025 will bring, but we know this: capital doesn't stay idle for long.

At MWM, we are constantly attempting to bridge the gap between economic development and commercial real estate. We feel now is potentially the best opportunity we have ever had to achieve this goal. While some communities have been understandably cautious about private partnerships, the reality is both sides need each other now more than ever.

Communities need quality jobs, long-term tax revenue, and smart, sustainable growth. Developers and investors are sitting on capital, and they're looking for credible public partners. If both sides are willing to meet in the middle, there's a real chance to build something greater than either could on their own.

Lucas Witt

Co-founder

MWM Consulting